Today almost no one is any doubt that the transformation of banks into large Platforms as a Service ( PaaS) through app programming interfaces is a development that’s here to stay. This is a win-win scenario: for customers and users, who can find new services and products related to their accounts; developers, who can become innovative teams capable of generating real changes; and for banks, who can explore new forms of revenue.

At the end of the road there’s an even more important goal: transparency and the fight against corruption and bad banking and financial praxis. This is not a trivial goal. It’s not simply a way of exploring new sources of income and making more profits. It’s a step towards a more sustainable and more open model that takes better care of the customers. In this climate of revitalization, APIs act as a catalyst for the process of opening up and sharing spaces with third parties.

The Open Bank Project: what is it and what’s it for?

Open Bank Project is an open-code API and an app store that allows financial institutions to make use of the talent and development of third parties to improve their customer products and services. The project was founded by Simon Redfern, CEO of TESOBE, the German software company headquartered in Berlin and the embryo of the Open Bank Project. They specialize in developing app programming interfaces in the Scala and Python languages.

This API provides a uniform technical interface for all the programmers and a secure space for the creation of new services at the top end of each bank or financial institution. It might be thought that this scenario would vastly increase insecurity and the lack of customer privacy, but this is never the case:

● The process of registering users is always done from the bank side, so it always has all the bank’s security requirements. Neither the API nor the apps have access to the username and the password.

● Because the API is open-code, security is vastly increased for two reasons: the first is that errors can be resolved much earlier and more quickly because there are far more eyes and more developers using the interface. And second, there’s no dependence on a provider.

As noted in the project itself, here are a some of the benefits of its API and its app store:

● Wide range of web and mobile apps for its customers.

● Reduction of maintenance and integration costs.

● More control and security over documents.

● Makes use of the talent and the community of developers. In this case, there are several elements that programmers may find very attractive: integrations in bank accounts via an API REST for the creation of new products, all under a widely-used security protocol such as OAuth, apart from traditional banking criteria, and as platform for showcasing their personal talent to third parties.

Open Bank Project fulfills an even more important mission, namely as a value input to an even higher concept: the Open Banking Standard. In this new process of banking transformation there are two important milestones:

1) September 2014, when the British Treasury Department (HM Treasury) published a report explaining how app programming interfaces could be a good tool for using shared and open data without compromising security or privacy.

2) And March 2016, when the British Open Banking Working Group (OBWG) finally published the document on the Open Banking Standard, which defines the cohabitation space between the data’s owners and users to create products, services and apps.

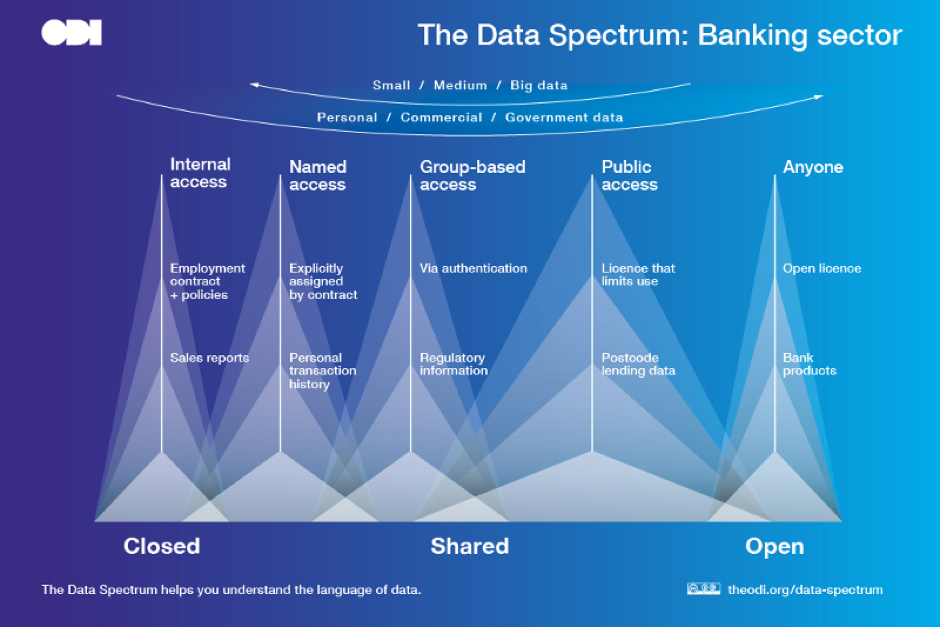

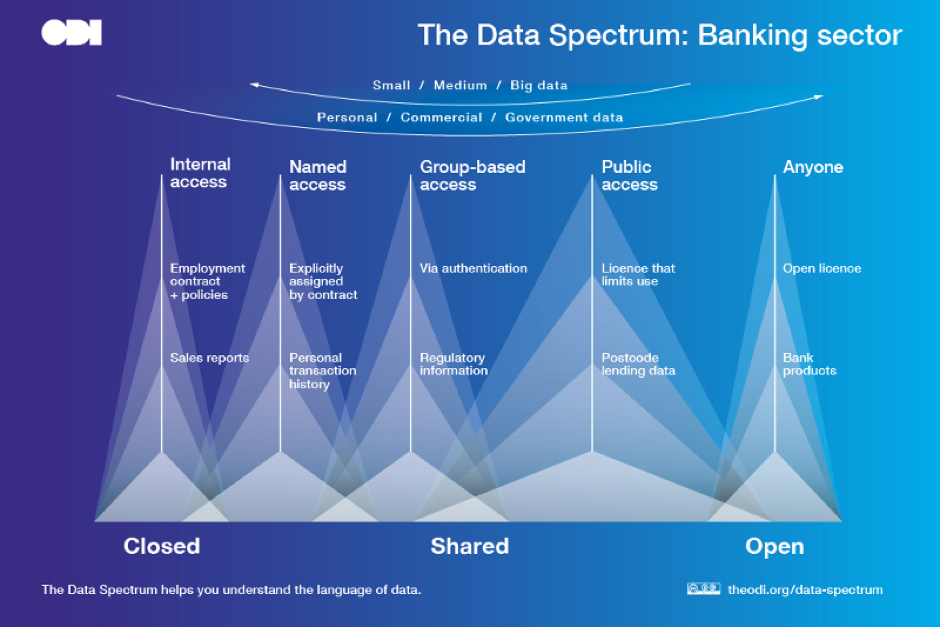

This standard recommends open APIs for financial institutions for two purposes: open access to local data and shared access to private data.

The idea of an open API is not that the data are open, but that the app is supported by a technology and interface with uniform and open access. In this scenario, and more so in the banking sector, access to data requires authorization, and the ownership of the information on financial products would be under a Creative Commons CC-BY license, where the beneficiary of the license has the right to copy, distribute, exhibit and represent provided the author is cited.

The document from the British Open Banking Working Group wants customers and developers to be able to access the information easily and for banks to open up in order to access a greater number of potential users.

“>Examples of work with the Open Bank Project

There are already some service apps currently available thanks to the Open Bank Project and to the initiative of teams of developers in fintech companies.

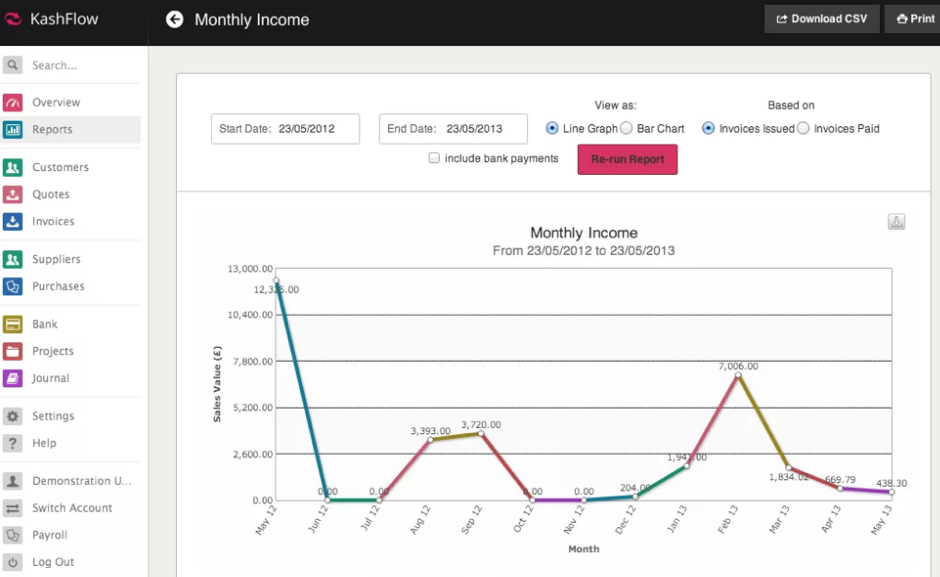

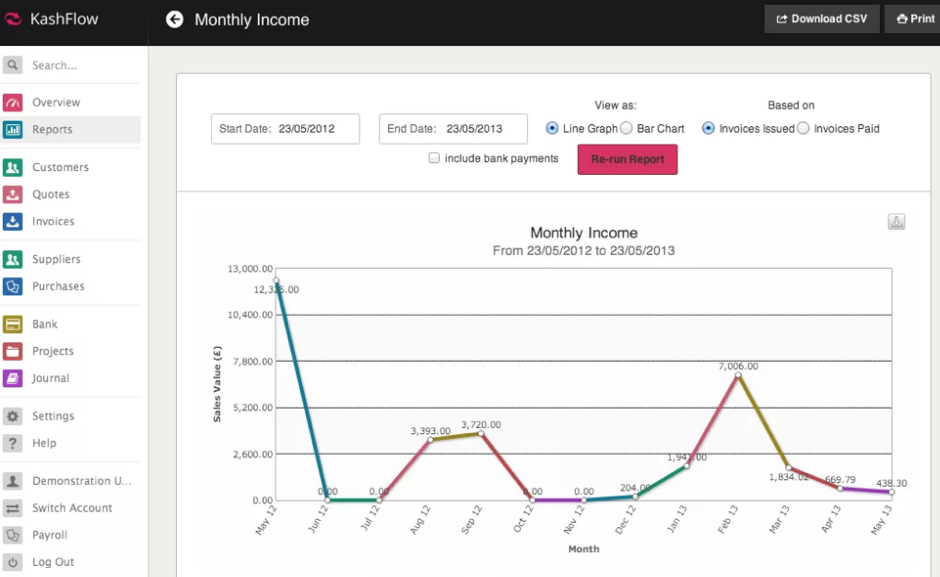

● Kashflow is an invoicing software that’s easy to use without any previous in-depth knowledge of accounting. You can either start from scratch or export existing invoicing data from other platforms or programs. It generates simple graphs to allow users to balance their income, expenditure and profits, that are easy to understand at a glance. It also has two very interesting functionalities: automated purchasing and the control of transactions linked to bank accounts.

● Pocket Money Sorted is an app available for iOS and Android aimed at changing the way in which families spend their income. One of its most interesting functionalities is that the tool teaches the younger members of the family to manage the money given them by their parents, who can share access and control. This can be done because each family member has his or her own username and different roles.

If you want to know more about BBVA’s Open Platform you can visit this website.