Banking has been one of the last sectors to adopt social networks as a new communication platform. A good example of this is that it was not until 2013 when many banks in the United States began to offer mobile applications to interact with their customers.

However, today many banks around the world are turning to social networks in order to create new financial services and, especially, to improve customer service. Just to mention some relevant examples: DenizBank, from Turkey, and ASB Bank, from New Zealand, were the first in the world to offer direct access to banking accounts through Facebook. Isbank, also from Turkey, has an iPad app that allows users to perform a wide range of functions, as well as purchase tickets for events and download books. BNP Paribas and ING Direct are also examples of banks with specific accounts in Twitter dedicated to customer service.

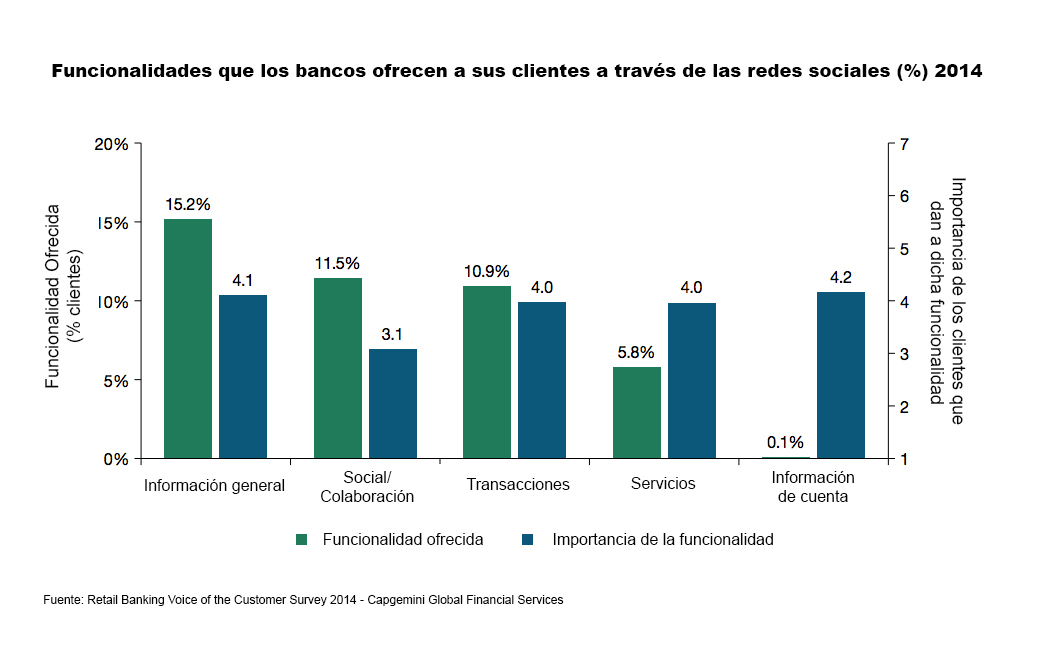

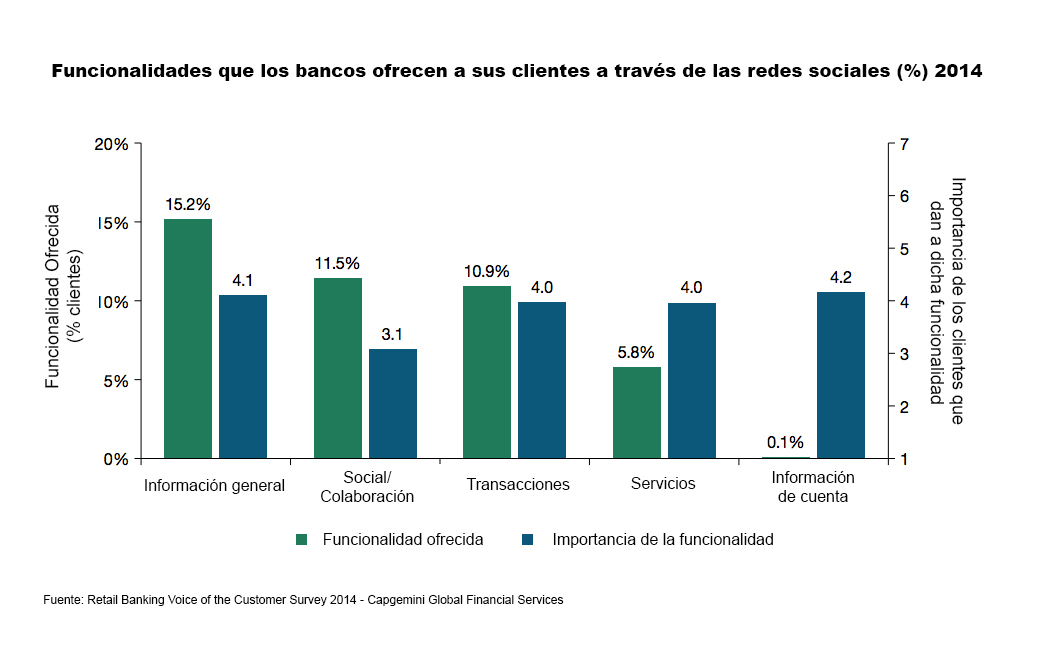

In general, there are many banks already using platforms like Twitter, Facebook, Flickr and Pinterest, and professional networks like LinkedIn or Google+, as online information resources with the aim of offering the same level of detail that a customer would find in a physical office or a website. Therefore, it is not surprising that, according to the report The future of Retail Banking 2014 by Business Insider, social networks, together with mobile services, are the only two channels whose percentage of users increased last year.

A good market also for entrepreneurs

But social networks are something else. Social technologies can be applied not only to customers, but also to employees and even to third parties involved. In 2012, BBVA achieved a milestone by adopting Google Apps for its 110,000 employees, transforming the way people work within the company. One year later, the bank launched ‘Yo soy empleo’ (I am employment), a project using social technology to collaborate with third parties in order to create value through the community.

BBVA Chile, meanwhile, is seeking commercial partnerships with startups in any country to develop innovative businesses to build the digital banking of the future, i.e. try to reshape the way in which traditional banking is built and transfer it to the digital world. This is the goal of the third edition of the Innova BBVA program. The challenge is, through the collaborative culture, connect entreprises and entrepreneurs with the bank in order to generate together high-value solutions for customers.

Moreover, all these actions combining social technologies with mobility can become a new niche market for entrepreneurs, especially for those with a technology base which can create products and/or services targeting banks. We could see very good examples of this during the presentation of the winners of the InnovaApps+ competition, whose applications represent perfectly the different possibilities that an entrepreneur can exploit in a market like banking.

Thus, for example, the winning app MyOffice.Glass allows companies (in this case BBVA) to control various aspects of the organization, such as managing the reservation of meeting rooms, check the occupancy of the building’s cafes and canteens, book paddle courts, etc. Meanwhile, the BBVA Dining+ application, designed for web and mobile phones, allows to enrich the user experience of those dining at BBVA buildings. Among its features it includes the ability to optimize the management of the canteens and know their occupancy rate.

As we can see, the role that digital innovation has and will have in the financial sector will be key to their future, especially in what refers to the retention and attraction of customers, particularly the younger ones, who have grown up with social networks and continue to perceive them as an essential part of their lives. Besides, thanks to social networks, banks will be able to identify customer needs they did not know about.

To be prepared for this vision of the future, according to the report ‘World Retail Banking 2014’ by Capgemini and EFMA, banks have to take several steps. The most important one is considering an omnichannel approach for service delivery, which will ensure the customer a seamless experience. The reality is that the ability to access social technologies anytime and anywhere will continue to expand, as mobile devices become more ubiquitous and offer greater functionalities.