Various case studies are used to show how open finance enables the financial inclusion of SMEs and the economic growth of developing regions.

Open finance is the next iteration in open data for banked environments. This line of banking, which has developed directly and specifically from open banking, offers clear advantages over previous scenarios, and paves the way for financial inclusion or economic growth and stability in developing countries.

An open finance case study

Open finance is a new way of engaging with customers and their data. Using open finance, “customers can grant permission to third parties to access certain private information or perform specific transactions on their behalf, usually through APIs”. Let’s look at a specific example.

A female entrepreneur in a rural Spanish municipality, knowing how hard it is for people to get ready access to cash in the region, has enabled the electronic payment option on her platform. Although it took a couple of months to bring around first her neighbors and then the rest of the customers across throughout the region, integrated payment is now the default option.

Thanks to the Payments PSD2 API, her customers can make integrated orders all within the same single purchase process. Payment APIs go largely unnoticed but they are catalysts for more dynamic business in the region, and financial institutions can increase their business too. This businesswoman has also added Checkout Financing to her platform.

Users of this open-finance API can apply for financing when paying for a product, no matter which bank they are with. Customers without cash have continued to buy thanks to these two tools, while businesses sell more products because the same customers have easy and secure access to financing.

For the businesswoman in this case study, open finance and bankable APIs are key ways to combat rural depopulation, which threatens her region, and are a good way of driving business – so the net balance is definitely positive.

Open finance is a major aid to financial inclusion, as will be discussed below.

Open finance: toward greater financial inclusion

The relationship between open banking and financial inclusion has long been established, and the World Bank supports it. Opening up the banking infrastructure to third parties with the approval of the user and customer is a cornerstone of financial inclusion. Open finance goes even further, enabling data exchange between financial institutions.

This opens the door to all kinds of actors and roles, from traditional banks to crowdlending platforms, which are integrated and stimulate the mobility of capital flows (sometimes small flows, as shown in the following example) providing stability for developing regions.

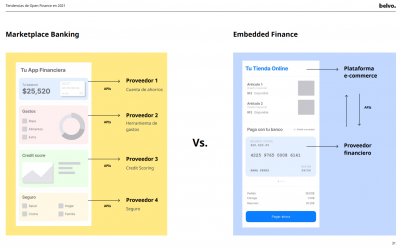

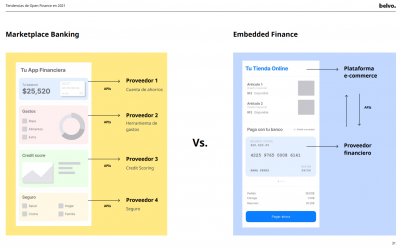

The chart above shows the huge difference in architectures between marketplace banking and embedded finance. On the left we have a fragmented and compartmentalized system in which each provider is responsible for a specific part of the process, while on the right is a clean environment for customers (e.g., a businesswoman) where the API ecosystem is focused on service integration.

Open finance microcredits for development

Microcredits have proven to be one of the most effective tools when it comes to promoting the social development of regions in economic growth, particularly those that are emerging from poverty and are often called ‘developing regions’. The Horn of Africa in Somalia is one such place:

A Somali farmer decides to use a small reservoir to collect the rainfall on his land, so that when the next La Niña comes he is ready and can beat the drought. His whole family lives off the family business, and many of them are employed in it. Before, he would have had to spend a day traveling to Bosaso by motorcycle for these kinds of arrangements to improve his business.

The farmer washes his hands before turning on the phone while one of his sons assists him in the process. He has been using a micropayment app for several months to buy tools and materials, as well as to close sales. Now, he only has to travel to distribute his products – because practically all the sales are digital.

The side menu includes an option to apply for loans in traditional banking mode and microcrowdlending for small projects. He chooses the latter, as he doesn’t actually need that much money to buy the materials (he and his family do the assembly). He describes his project and uploads it to the platform.

This entrepreneur might not realize it but he has used an API that connects the app to various banking services and some other marketing and communications services. Part of his family in Burao and Hargeisa receive an instant confirmation of their loan. A dozen people pool their resources to send funds to this enterprising family member, which he will repay at a low interest rate.

Several months have passed, and the reservoir has been built. It can hold several tens of thousands of liters of water, and a white cover will prevent rapid evaporation. On the western horizon, storm clouds are rolling in, from La Niña, shedding rain over the desert for a couple of days every few weeks. Today the family is more confident that their business and their livelihood will survive.

Increased banking penetration in financially underdeveloped countries

Access to financial services, according to the World Bank, “is key to reducing poverty and boosting prosperity” because “it means, for individuals and businesses, having access to useful and affordable financial products that meet their needs.” It gives the examples of transactions, payments, savings, credit, and insurance.

Banking penetration in underdeveloped countries, with a focus on financial inclusion, means families can seek other ways to manage their economies. Families can use these services to plan better for the mid and long term, making day-to-day life easier thanks to simple products such as a bank account that acts as a virtual wallet; they can also use micro-payments or acquire micro-credits to cover emergencies and unforeseen events.

They can also open new lines of family business, or expand existing ones, providing greater stability – something we often taken for granted in wealthy countries. This is all part of financial inclusion. The World Bank stresses that “a propitious policy and regulatory environment” fosters competition and innovation, which will lead to development and banking penetration.

Open finance helps put an end to poverty thanks to tools such as bankable APIs, which allow the integration of dozens of services into the ecosystem of money flows and thus the flow of capital.

Images | Thom Holmes, Belvo, Ivan Bandura